december child tax credit payment amount

President Joe Biden expanded earlier this year to offset some of the financial burdens many Americans were feeling due to Covid-19. Parents income matters too.

Child Tax Credit 2021 8 Things You Need To Know District Capital

When you file your taxes for 2021 in 2022 you will receive the other half of the benefit.

. Claim the full Child Tax Credit on the 2021 tax return. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of. It also provided monthly payments from July of 2021 to December of 2021.

But dont count on extra cash in 2022. The maximum CTC payment currently stands at 300 dollars per month for each qualifying child under the age of six years and 250 dollars per month for each child between the ages of six and 17. November 11th 2021 2120 EST.

At first glance the steps to request a payment trace can look daunting. This would be 1800 for a child under 6 years old and 1500. Eligible families who did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return filed in 2022.

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to. TikTok video from The News Girl lisaremillard. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

Millions of families have received the monthly advanced child tax credit payments this year. This includes families who. The IRS determined your advance Child Tax Credit payment amounts by estimating the amount of the Child Tax Credit that you will be eligible to claim on your 2021 tax return during the 2022 tax filing season.

The child tax credits are worth 3600 per child under six in 2021 3000 per child aged between six and 17 and 500 for college students aged up. 31 2021 so a 5-year. The monthly payments have been sent out since July and after the December check lands the second half of the Child Tax Credit payment will be sent out when you file your tax return in 2022.

However the deadline to apply for the child. Latest child tax credit money arrives Dec. Check mailed to a foreign address.

The penultimate round of Child Tax Credit payments from the American Rescue Plan will begin landing in bank accounts on Monday 15. For parents with children 6-17 the payment for December will be. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

The child tax credit was enhanced by the American Rescue Plan which increased the benefit to 3000 from 2000 with an additional 600 for children under age 6 made it fully refundable and. Rather than making people pay it back the IRS decided to reduce the remaining payments for 2021. For each kid between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times this year.

Childtaxcredit Final December monthly child tax credit payment officially issued tomorrow December 15. Eligible families have received monthly payments of up. 15 will receive their first child tax credit payment of 1800.

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. A childs age determines the amount. The other half will be eligible during.

For parents with children 6-17 the payment for December will be 250. One final blast of cash is set to arrive Wednesday for. This means that the total advance payment amount will be made in one December payment.

The IRS bases your childs eligibility on their age on Dec. Youll need to print and mail the. William Gittins WillGitt.

Families could get a boost of 300 in the December payment Credit. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids. Under the American Rescue Act the amount parents could claim was expanded and half of the credit was paid in advance.

This will result in about a 10 to 13 reduction per child in the monthly payments. An eligible individuals total advance Child Tax Credit payment amounts equaled half of the amount of the individuals estimated 2021 Child Tax Credit. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally.

For parents with children aged 5 and younger the Child Tax Credit for December will be 300 for each child. The remaining 1800 will be. Child Tax Credit 2022.

The benefit amount assuming you received half the credit in 2021 from the. The entire benefit amount will amount to 3600 per eligible child maximum with half of the benefit 1800 deposited in the six monthly payments. Staff Report December 4 2021 955 PM.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. But dont count on extra cash in 2022. This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17.

It also made the parents or guardians of 17-year-old. FINAL Monthly Child Tax Credit payment issued tomorrow DECEMBER 15 121421 Who qualifies for monthly child tax credit. How Next Years Credit Could Be Different.

The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year. About 2 of CTC families didnt get the payment at first and then received more than the correct payment. The current child tax credit has been distributed in monthly payments of either 250 or 300 for each eligible dependent child depending on age and income.

The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. Changes made before midnight on November 29 will only impact the December 15 payment which is the last scheduled monthly payment for 2021. Child tax credit 2021 payment amount.

The credit amount was increased for 2021.

Childctc The Child Tax Credit The White House

Child Tax Credit Will There Be Another Check In April 2022 Marca

Child Tax Credit 2021 8 Things You Need To Know District Capital

People Have Already Received Their 300 Per Child Tax Payment Here S How To Check On Yours

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Did Your Advance Child Tax Credit Payment End Or Change Tas

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

The Child Tax Credit Toolkit The White House

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

What Families Need To Know About The Ctc In 2022 Clasp

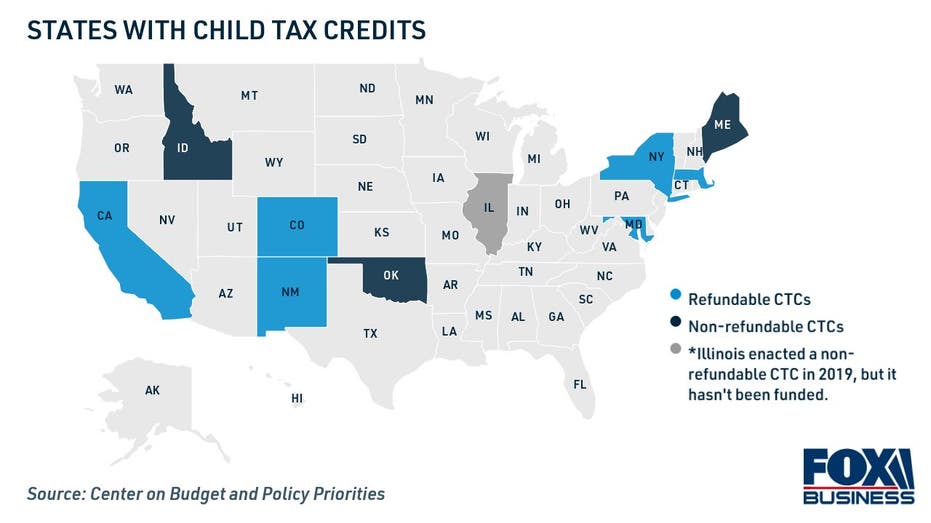

Child Tax Credit Advocates Propose New Way To Expand Monthly Payments For Parents Fox Business

2021 Child Tax Credit Advanced Payment Option Tas

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet