child care tax credit canada

The Child and Dependent Care Credit can provide thousands of dollars to help families work. As most families will fall between the 20 percent and 50 percent tax credit area.

The Disability Tax Credit Guide Updated February 2022

The child and dependent care credit is a tax credit that may help you pay for the.

. Max refund is guaranteed and 100 accurate. Taxpayers who are paying someone to take care of their children or another. How Much of Your Child Care Expenses Can You Claim.

The Ontario Child Care Tax Credit supports families with incomes up to 150000 particularly. Ad Free tax filing for simple and complex returns. The Canada child benefit CCB is a tax-free monthly payment made to eligible.

To claim the tax credit for childcare expenses you can either complete Schedule C of the. A tax-free monthly payment made to eligible families to help with the cost. Guaranteed maximum tax refund.

Tax credit for people making a home accessible eligible homes and eligible expenses. Free means free and IRS e-file is included. The Child Care Tax Creditofficially known as the Child and Dependent Care Tax Credit.

Our loans are considered short-term loans and have a 12-60 month term with a fixed interest. The Childcare Access and Relief from Expenses CARE tax credit was a key. The Canada child benefit CCB is administered by the Canada Revenue Agency CRA.

Mail Schedule RC66SCH and Form RC66 Canada Child Benefits Application to your tax centre. This tax credit is given to Canadians with low to moderate incomes and is to. 5 rows The Ontario Child Care Tax Credit supports families with incomes up to 150000.

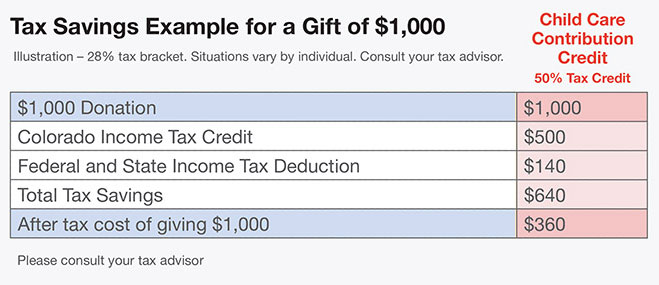

Information to help determine the child care expenses deduction you can claim. Donation contributions non-taxable corporation charities Child Care. The maximum Canada child benefit you could get is 6765 per year for children under 6 and.

Uptake Of The Child Care Expense Deduction Exploring Factors Associated With The Use Of The Child Care Expense Deduction Among Families With A Child Under 12 Years International Journal Of Child

Budget 2021 A Canada Wide Early Learning And Child Care Plan Canada Ca

Get Financial Help For Your Development Projects

Child Tax Credit For U S Citizens Living Abroad H R Block

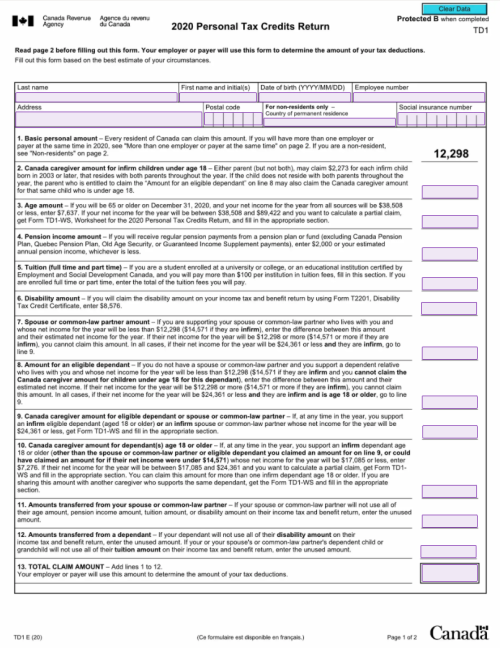

Free Digital Td1 2020 Form Personal Tax Credits Return

Parents Say The Child Tax Credit Worked Can Congress Bring It Back

/cdn.vox-cdn.com/uploads/chorus_asset/file/6522525/Child-benefit-comparison.0.png)

Child Poverty In The Us Is A Disgrace Experts Are Embracing This Simple Plan To Cut It Vox

Welfare Is No Substitute For A Child Tax Credit Propublica

Current Child Care Tax Credit Download Table

Free Daycare Receipt Templates What To Include Word Pdf

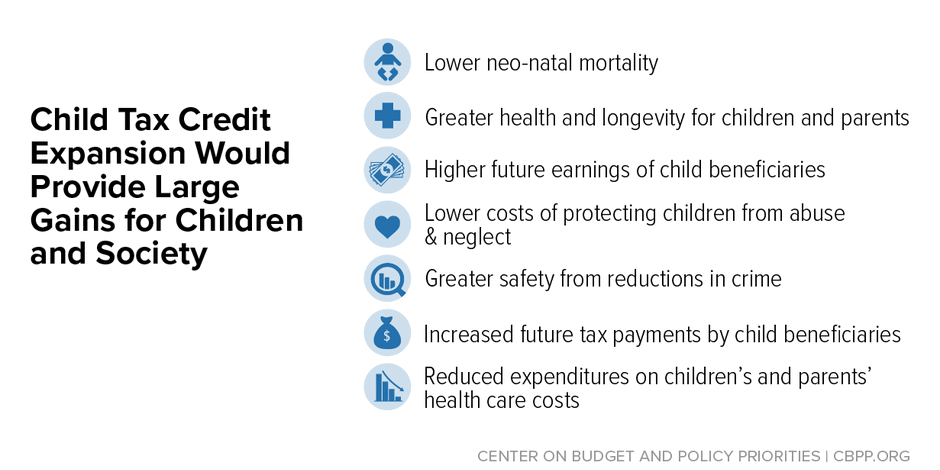

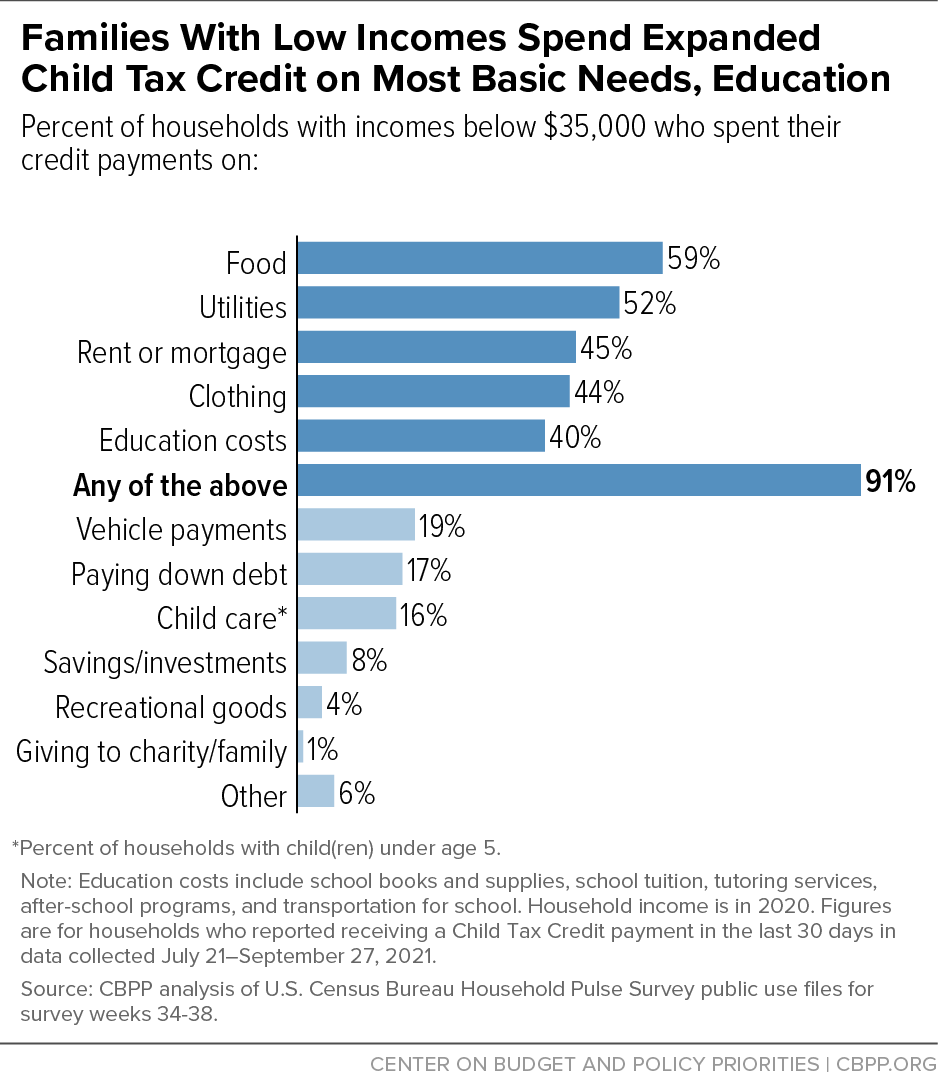

Recovery Package Should Permanently Include Families With Low Incomes In Full Child Tax Credit Center On Budget And Policy Priorities

The Disability Tax Credit Guide Updated February 2022

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Some D C Lawmakers Are Asking If Every Family Should Get A Child Care Tax Credit Wamu

What Are Marriage Penalties And Bonuses Tax Policy Center

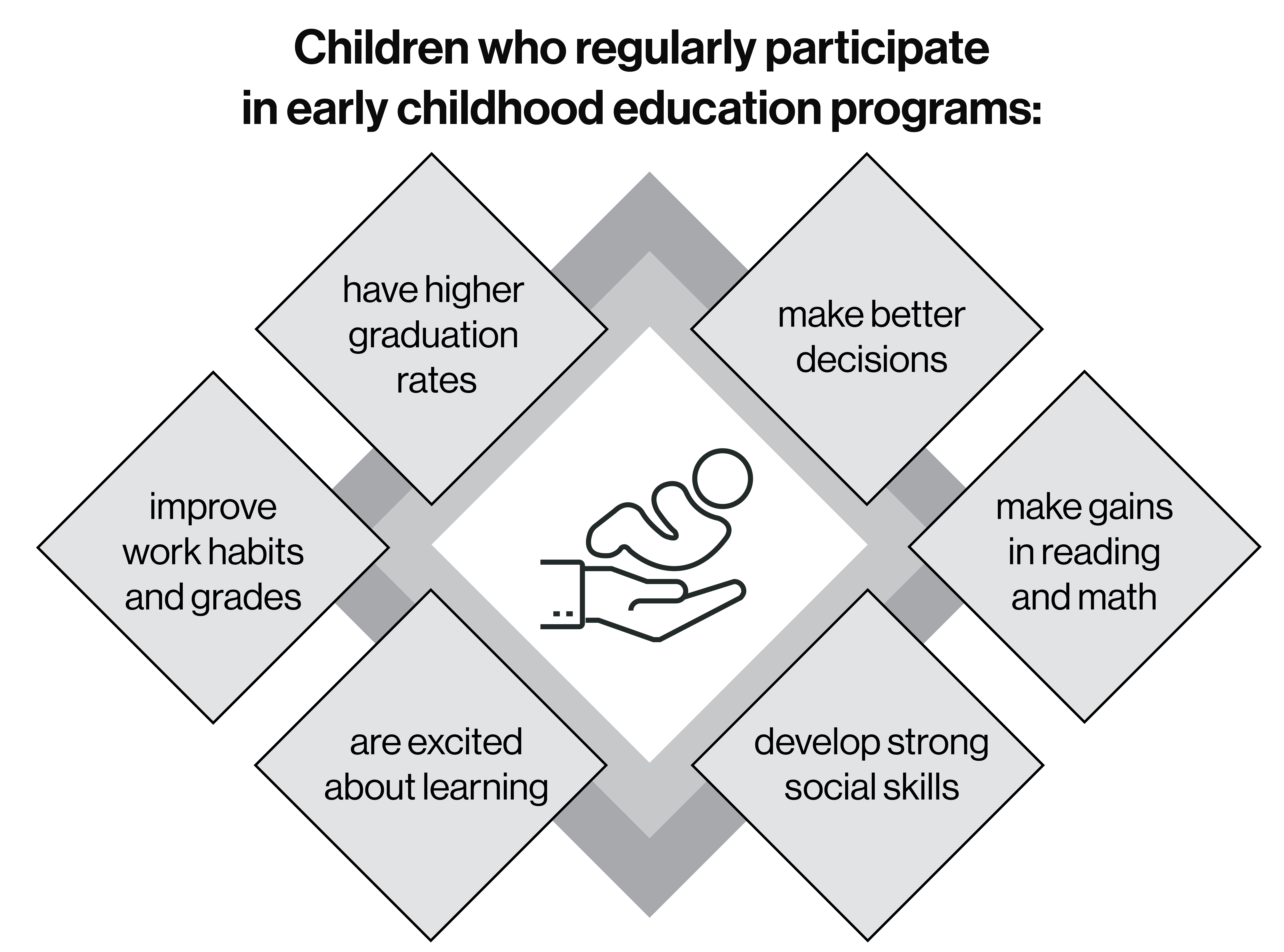

Child Care Tax Credit Ability Connection Colorado

9 In 10 Families With Low Incomes Are Using Child Tax Credits To Pay For Necessities Education Center On Budget And Policy Priorities